Swiss Life can look back on a long and eventful history. From its founding, which was only possible with the help of the then Kreditanstalt, through the turbulent years following the First World War to its establishment as a major life insurance company in Europe: a look back at some episodes from the company’s eventful history.

Kreditanstalt steps in as guarantor

In 1855, the Zurich cantonal councillor Johann Jakob Sulzer asked lawyer Conrad Widmer to look into the idea of a Swiss life insurance company. For Widmer to turn his vision into a reality, he needed a financially strong partner to support the project with guaranteed capital. After being turned down by a bank, Widmer turned to the Schweizerische Kreditanstalt, later Credit Suisse, which had been founded a year earlier. They were straightaway open to the idea and the company agreed to act as a guarantor for Rentenanstalt with its entire share capital of 15 million francs. Kreditanstalt advanced the funds at a 5% rate of interest for as long as needed and initially received a share of 40% of Rentenanstalt’s annual net profit.

Under these conditions, the Zurich government approved the foundation of Rentenanstalt in 1857. In 1879, the articles of association were revised to the effect that Kreditanstalt was to withdraw from the guarantee relationship as soon as Rentenanstalt had assets of 20 million francs. This happened in 1885, when Rentenanstalt then became a mutual insurance company.

In 1855, Lawyer Conrad Widmer looked into the idea of a Swiss Life insurance company. Two years later, the Rentenanstalt was founded.

Rapid expansion abroad

Shortly after it was founded, Rentenanstalt expanded its activities into neighbouring countries. Firstly, this was in order to make its own products available to a wider group of people. Secondly, it wanted to create a broader risk base, as the risk of an epidemic spreading was not to be underestimated at the time. This was the case in 1918/19, when many people in Switzerland lost their lives to a flu epidemic, including almost 700 people insured with Rentenanstalt.

Branches were soon established in Prussia, Hamburg and Bremen, and later also in France and Austria. Rentenanstalt was also temporarily active in Constantinople, Tunisia, Algeria and Egypt. In 1900, it also started operations in the Netherlands. At one point, however, Rentenanstalt almost turned its back on Zurich. Following a tax dispute with the canton, the company was on the verge of relocating its headquarters to Brugg in Canton Aargau in 1888. However, after a settlement with the authorities, Rentenanstalt opted to stay where it was.

.jpg)

.jpg)

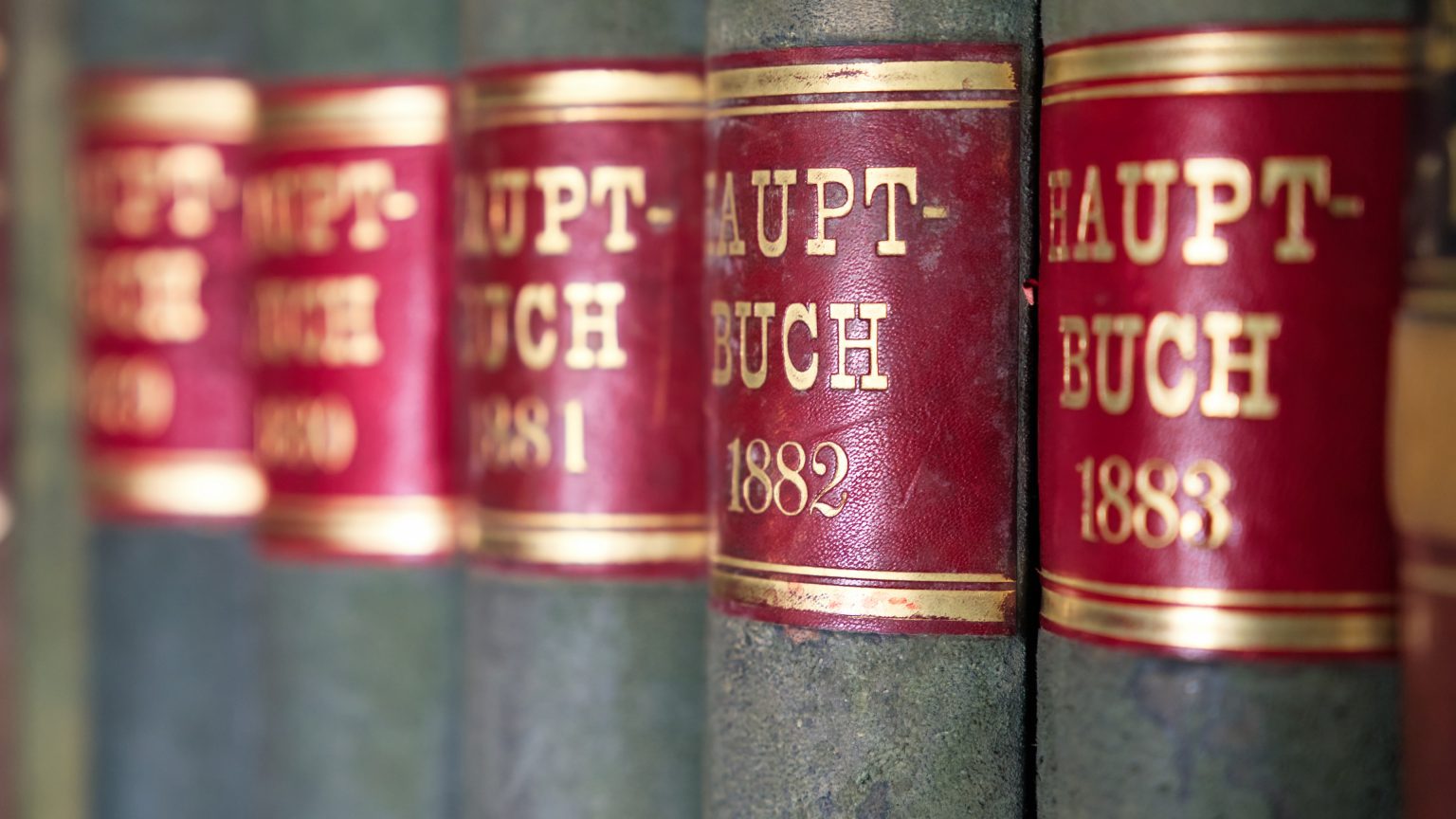

Rentenanstalt issued its first policy on 6 January 1858. Many more were to follow in the decades to come.

Slow modernisation

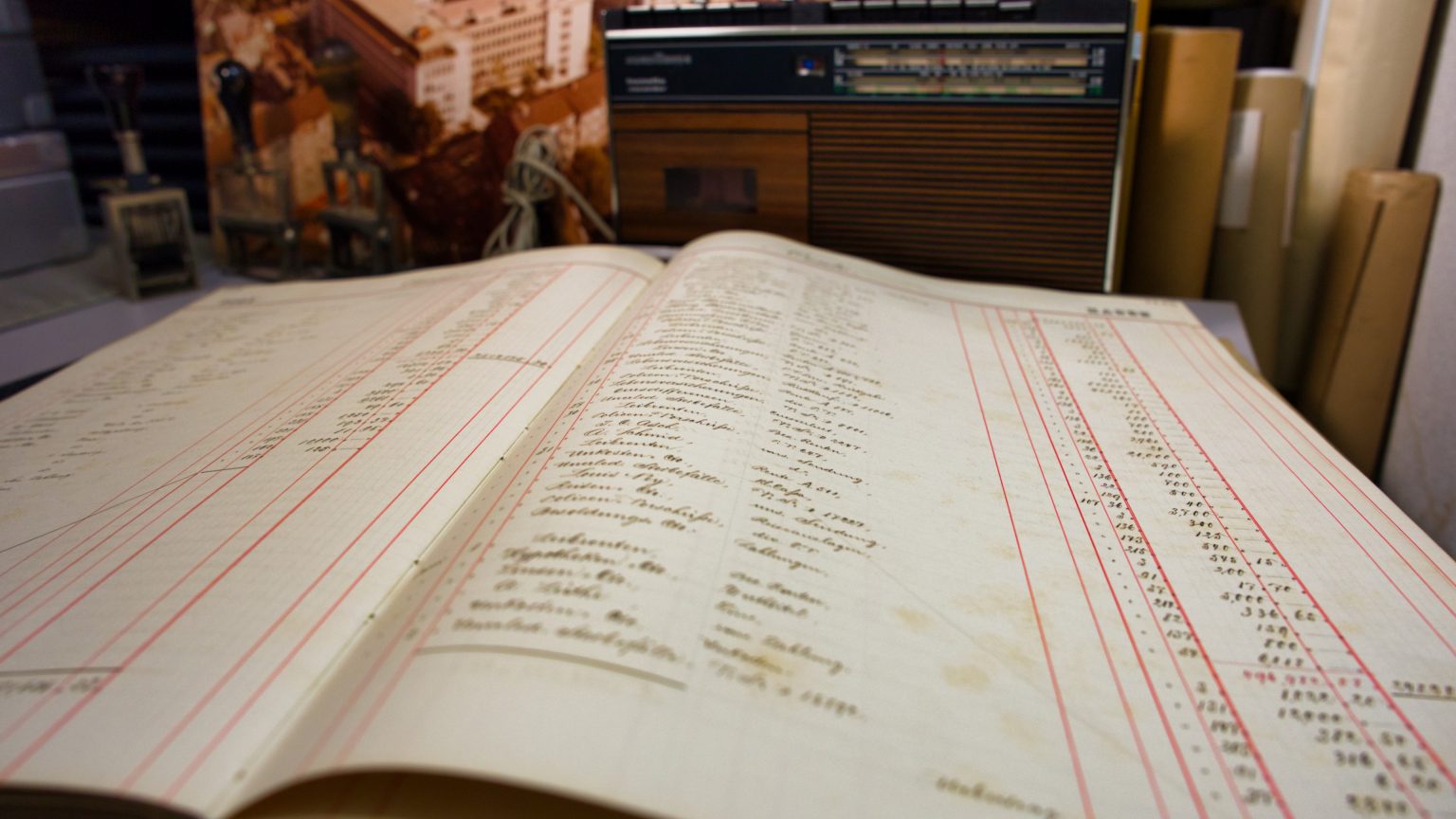

At first, the Rentenanstalt office was very modest. In the first decades, work was carried out in summer with daylight and in winter by gas light and kerosene lamps. All correspondence was written with a quill and ink, including the annual reports. With just a few exceptions, director Conrad Widmer signed all outgoing mail himself – until his retirement in 1892.

The company got its first telephone in 1885 – it was the only one for the entire staff. Almost at the same time, the chief mathematician received a calculating machine for which, according to his notes, he “exuberantly thanked management”. The changeover to typewriters was slow because Rentenanstalt still attached great importance to the art of calligraphy, especially when writing policies. These were written by hand up to the year 1920. In 1926 a far-reaching change took place in administrative operations with the introduction of the punch card method.

.jpg)

.jpg)

What is indispensable today was introduced at Rentenanstalt in 1885. In this year, the staff received the first telephone. (symbolic image)

Paying premiums with stamps

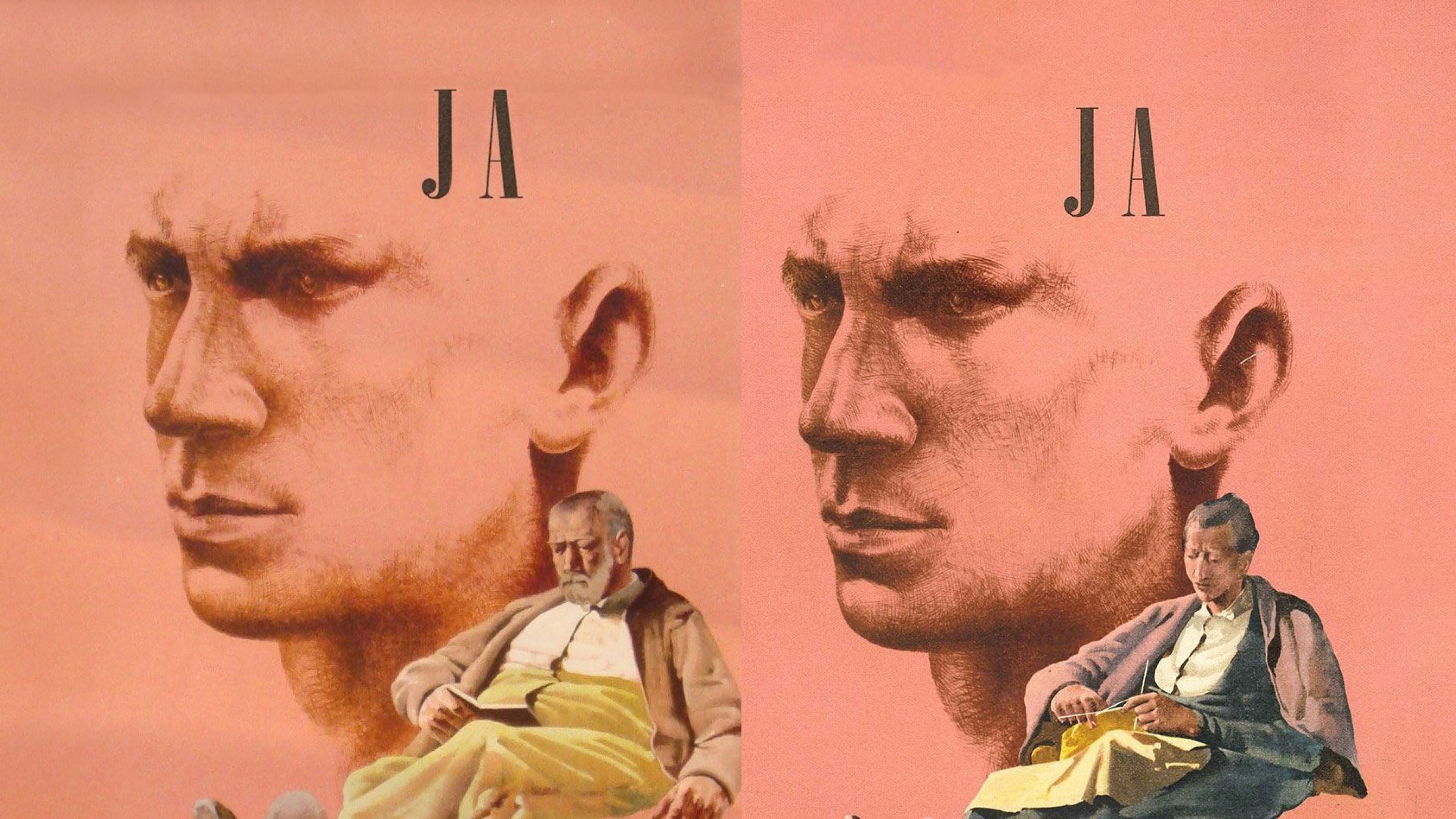

In 1892, Emil Frey took over from founder Conrad Widmer as the new director of Rentenanstalt. Two years later, he introduced public insurance in Switzerland, which is still regarded as a milestone in the history of Rentenanstalt. The aim was to offer life insurance on a solid financial and technical basis for the less well-off members of the public as well. The difficulty was finding a simple and inexpensive way to pay premiums that suited the circumstances of those insured. Frey had the idea to work together with Swiss Post, which had a nationwide network. The idea was that policyholders should be able to pay their premiums at a post office. In return, they received stamps that they stuck on a collecting card. Once the card was full, they sent it to Rentenanstalt, which then handed it over to Swiss Post and received the equivalent value in return. This method of payment was later replaced by postal cheques.

The “Public Insurance” department was built up and managed by Mathilde Pfenninger for a number of decades. She only hired women to her team, as in the working-class families of the time it was usually the women who managed the money and were therefore also the people that the insurance representatives would be contacting. The Public Insurance department was also the first to move into the new head office on the former Alpenquai in Zurich in 1940. When Pfenninger retired after 43 years, her team – with a total of 130 women – was the largest in the whole company.

This is what a public insurance booklet looked like. Many Swiss families had one in the early 20th century.

Hard years after the First World War

The First World War began an extremely difficult period for Rentenanstalt. The unprecedented devaluation of the German mark in 1922/23 meant that it was no longer worth collecting premiums in the German business because the resulting postage costs were higher than the actual contributions paid. When the mark plummeted to one trillionth of its gold value, Rentenanstalt’s 15 000 German policies were invalidated. Later, the law allowed for life insurance contracts and pensions to be revalued in Germany, which meant that Rentenanstalt’s policies also regained some of their original value.

France, too, suffered from a weak currency. A number of Rentenanstalt policyholders tried to compensate for the fall in the value of the French franc in an original way: they insisted that their insurance benefits be paid out to them in Swiss francs. They argued that the insurance benefits were stated in “francs” in the policies, without specifying that this meant French francs. Their arguments fell on deaf ears, however; their claims were rejected by all levels of French courts.

Rescue of Swiss policyholders

German inflation in the 1920s also had far-reaching consequences for Swiss policyholders. The eight German life insurance companies operating in Switzerland at that time had to invest their insurance policies taken out in Switzerland in Reichsmarks in Germany. When these fell massively in value, but benefits still had to be paid out in Swiss francs, bankruptcy appeared inevitable for them. In order to protect Swiss customers, the Federal government intervened and asked Swiss life insurers for help. The idea was for Swiss companies to split the policies of the German insurers amongst themselves. Rentenanstalt also took part in the rescue and took over a total of 13 600 policies from Leipziger Versicherungsgesellschaft and Atlas-Lebensversicherung in Ludwigshafen. At the time, this campaign generated a great deal of public sympathy for Rentenanstalt.

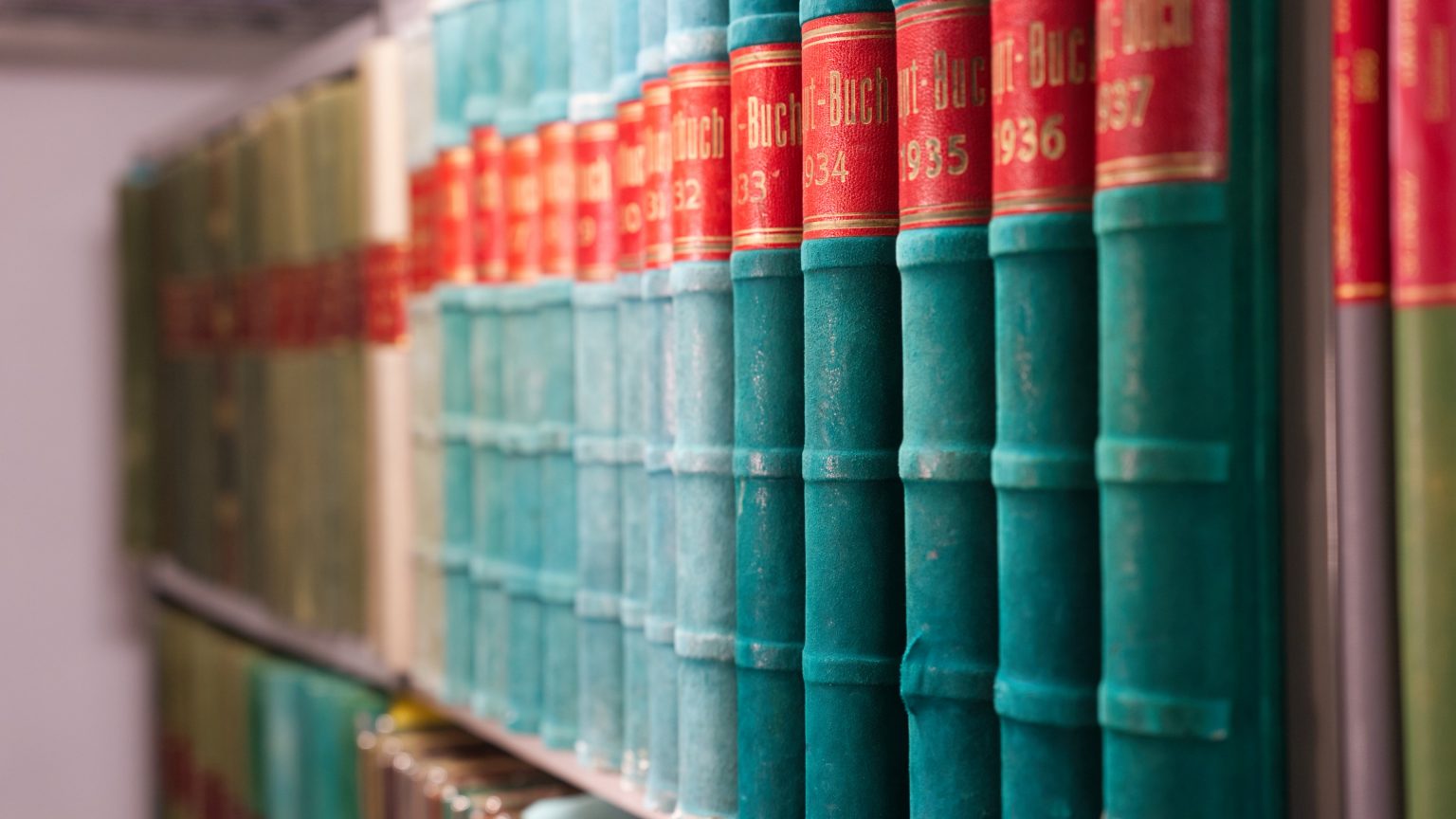

Increasing administrative operations

In 1957, Rentenanstalt held an exhibition to mark its 100th anniversary to show how much it had grown over the previous century. As part of this, it presented impressive figures on its administrative operations. At that time, the registry of insured people comprised 700 000 file folders and was spread over several floors. The details of these people were recorded on more than half a million punch cards, requiring 60 000 changes of address, occupation or name every year. At that time, around 4000 payments were received every day, which amounted to 1.2 million payments every year. Over the years, Rentenanstalt had grown from a small firm to a major insurance company in Europe.